Attract, engage, and support international students

A plug-and-play platform to support international students across the full lifecycle

Trusted by 800+ schools at 180+ US colleges & universities

Strategically reach international students at any stage!

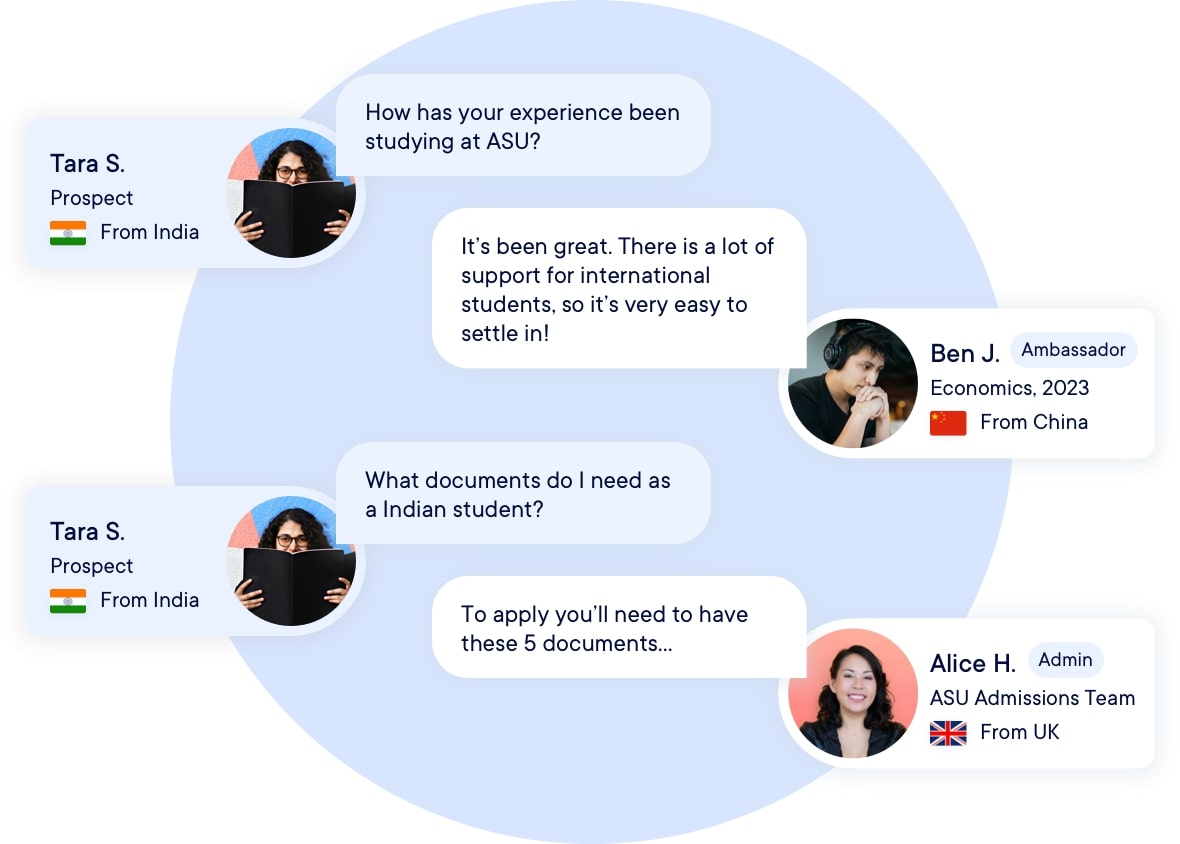

Effectively engage and enroll more international prospects

- Connect prospects 1:1 with student ambassadors & admissions officers.

- Leverage peer-to-peer marketing

- Authentically engage applicants to ensure they are receiving the support they need from early exploration stages through enrollment.

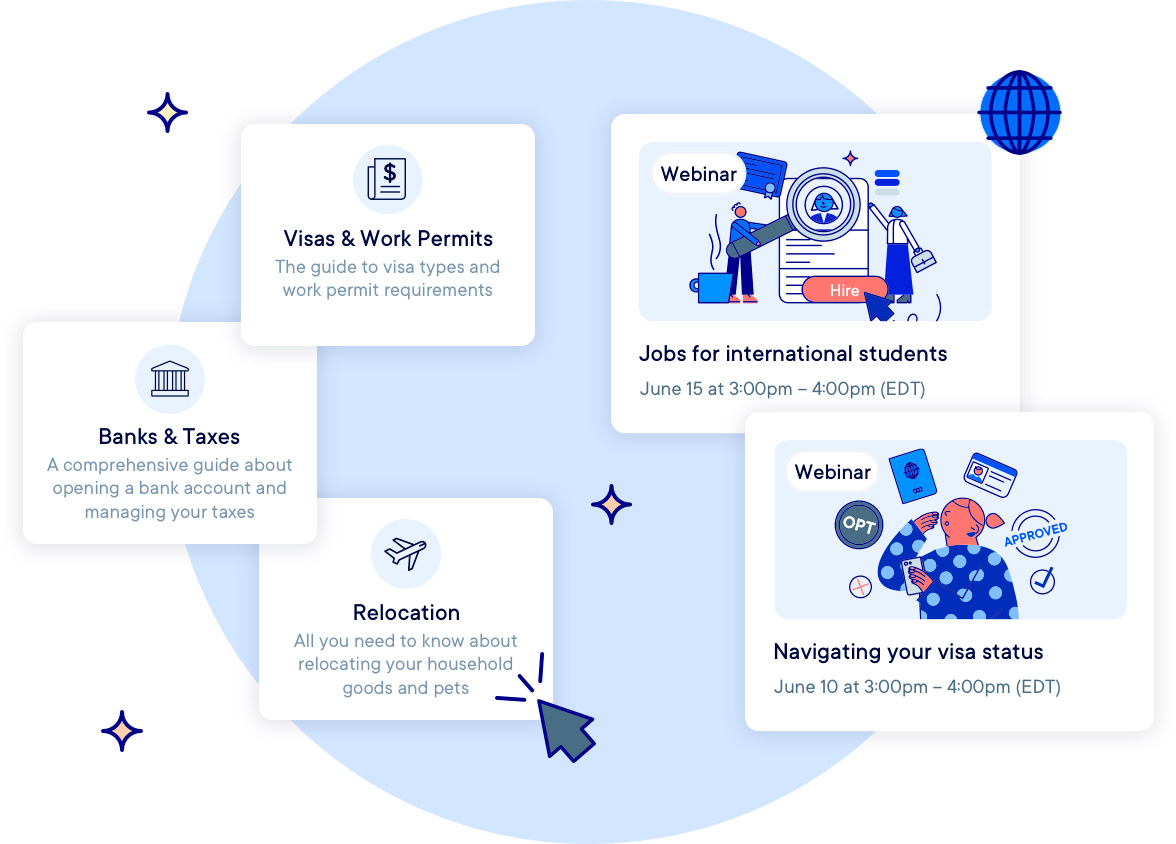

Empower your career center to better support international students

- Make a positive impact on existing international students

- Effectively support students in their job search, community building, and immigration journey from arrival through graduation.

- Access expert resources created specifically for international students

Boost alumni satisfaction and university reputation

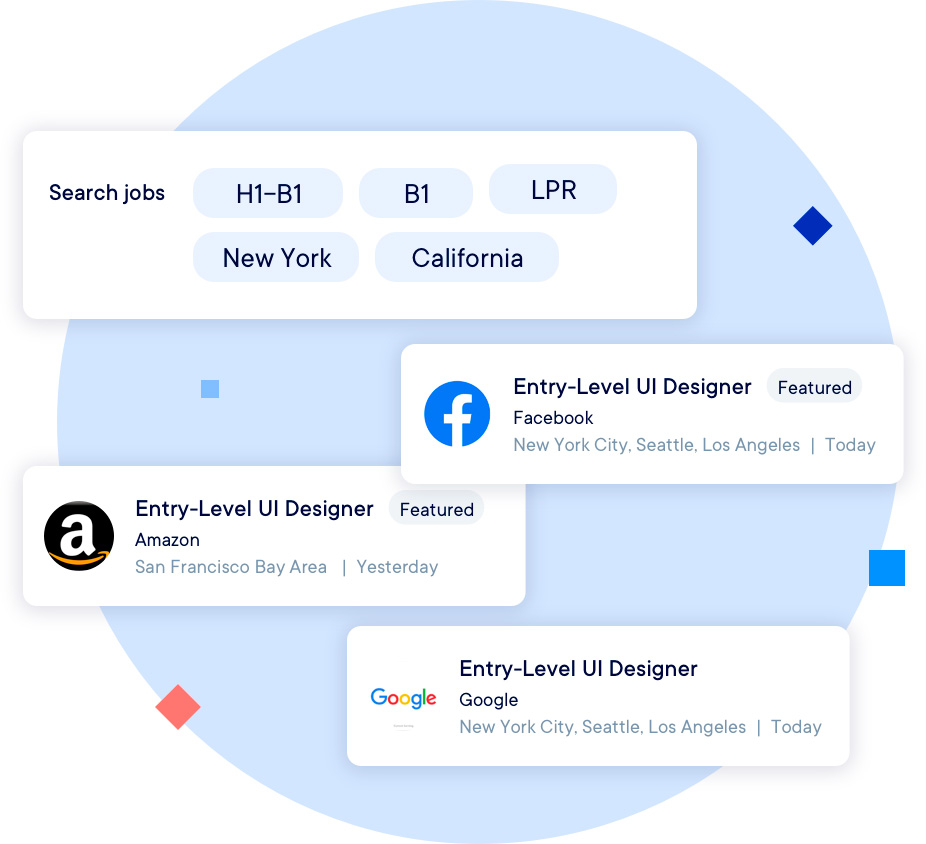

- Empower international alumni to build a successful career and life in the US after graduation

- Support them in navigating the complex immigration landscape

- Help them find meaningful employment opportunities

What’s meaningful to international students is clear

94%

of prospects want enhanced admissions support and consistent communication.

QS International Survey

60%

of students want tailored career support from their university’s career services

National Association of Colleges and Employers (NACE)

81%

of alumni want to stay in the U.S. to work or pursue further education opportunities

U.S. Immigration & Customs Enforcement (ICE)

Be a champion to international students

International students face unique and complex challenges. Empowering applicants, students, and graduates to make confident decisions about their future in the US starts with you.

Recommended by leading universities

We’re thrilled to offer new avenues for prospective students to connect with our thriving community of current international students. I am confident that this platform will significantly boost engagement and play a pivotal role in achieving our enrollment targets.

Caleb Bennett, Director of International Enrollment and Services at East Tennessee State UniversityInterstride provides an accessible and efficient way to facilitate these connections, particularly for smaller admission teams. It can greatly enhance the personal connections we make with students and parents around the world.

Jennifer Hirsch, Senior Associate Dean of International Admission at Claremont McKenna CollegeOne of the huge values for us is the expertise of the Interstride team and their partners in creating webinars, content, and resources. It just feels like Interstride is two steps ahead, or sometimes ten steps ahead of where we would be.

Greg Victory, Assistant Vice President of Student Affairs and Fannie Mitchell Executive Director, Duke Career CenterStudents find the webinars useful, and they also like the fact that they can just search for jobs and research companies that would sponsor them for H-1B visas. I’ve had several students reach out to me telling me that they have gotten interviews from companies that they found through Interstride. It’s been a very positive experience.

Julian Huenerfauth, Assistant Director for International Student Career ServicesInterstride provides exactly the same type of content that career centers are looking to provide. One of the challenges that career centers face when it comes to creating high quality content is that it takes a long time to create enough content to cover all the necessary areas of interest for international students. At Interstride, all of that content is baked in, and it is all highly relevant and of great quality.

Carly Smith, Director of Career EducationI had a student from the Philippines come to my office today who wasn’t sure how to get started with her internship search. I had her register for Interstride right there and then I walked her through how to use it. After giving her some networking pointers and encouraging her to watch one of your webinars tonight, she left my office practically dancing down the hall.

Bob McGee, International Career Manager